wichita ks sales tax rate 2020

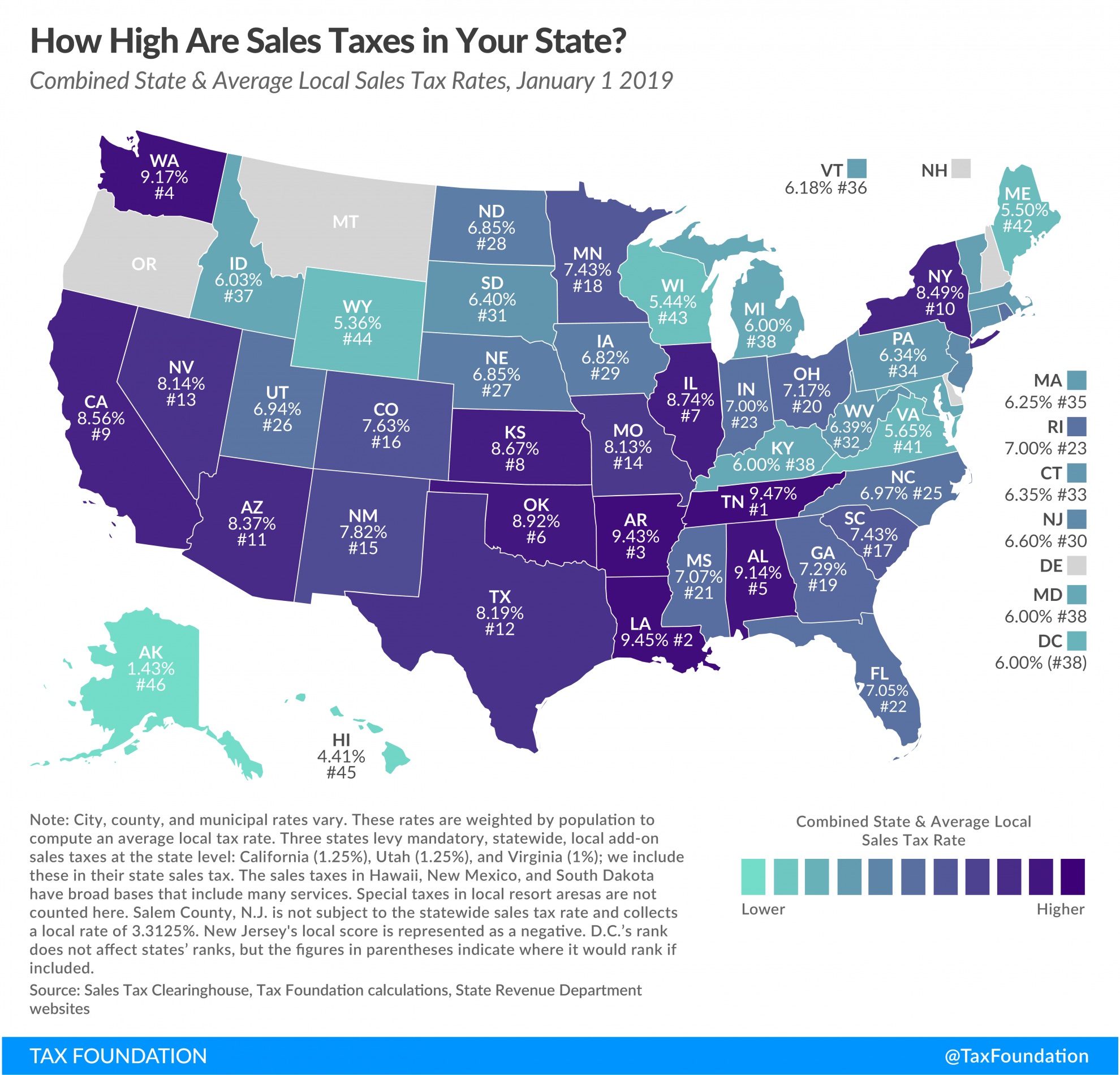

The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick. In addition to the state sales tax Kansas counties incorporated cities and special taxing districts may impose a local sales tax.

Kansas Department Of Revenue Selected Kansas Tax Rates With Statutory Citation

This means that depending on your location within Kansas the total tax you pay can be significantly higher than the 65 state sales tax.

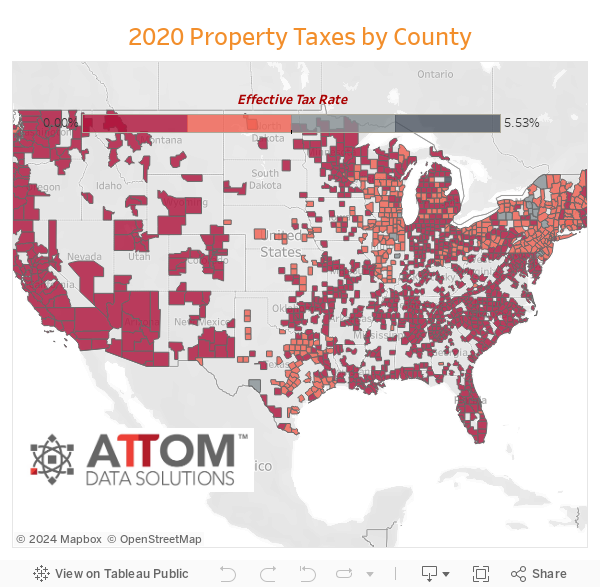

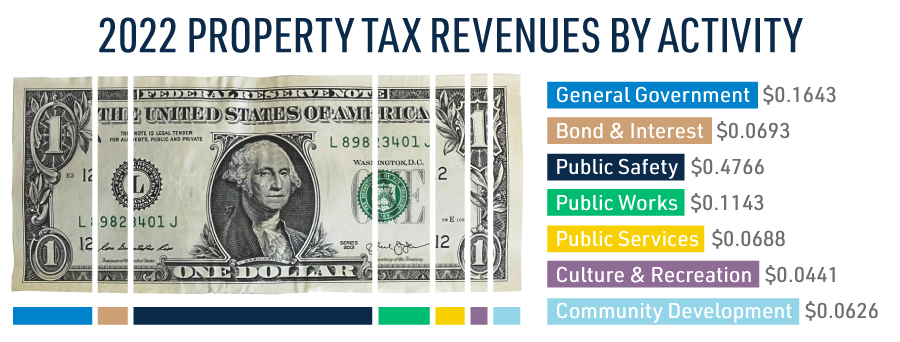

. In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290. The County sales tax. For 2021 the rate is 32758 an increase of 037 mills or 011 perent.

As for zip codes there are around 2 of them. This rate is the sum of the state county and city tax rates outlined below. The minimum combined 2022 sales tax rate for Wichita Kansas is.

The minimum combined 2022 sales tax rate for Wichita County Kansas is. Lower sales tax than 74 of Kansas localities. For a more detailed breakdown of.

Thats an increase of 1468 mills or 469. The City of Wichita property tax mill levy rose slightly for 2020. Kansas City KS Sales Tax Rate.

31 rows Hutchinson KS Sales Tax Rate. The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales. This is the total of state county and city sales tax rates.

Wichita county in kansas has a tax rate of 85 for 2022 this includes the kansas sales tax rate of 65 and local sales tax. Junction City KS Sales Tax Rate. This is the total of state and county sales tax rates.

The December 2020 total local sales tax rate was also 8500. Kansas has a 65 sales tax and Wichita County collects an additional. This is the total of state county and city sales tax rates.

Lawrence KS Sales Tax Rate. The December 2020 total local sales tax rate was. Andover KS Sales Tax Rate Andover KS Sales Tax Rate The current total local sales tax rate in Andover KS is 7500.

A full list of these can be found below. Only the proportion of net income. The current total local sales tax rate in Wichita County KS is 8500.

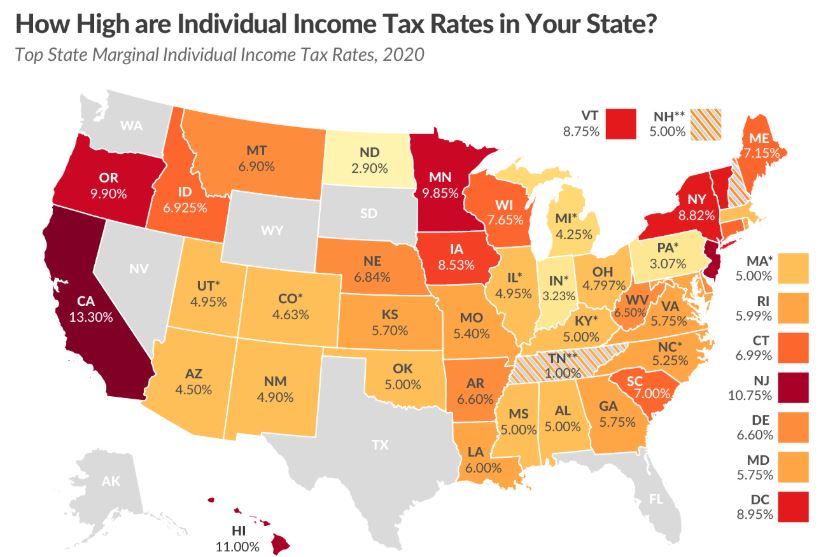

3 lower than the maximum sales tax in ks. In 2020 it was 32749 based on the Sedgwick County Clerk. Kansas corporate tax rate is 700 400 of Kansas taxable net income plus 300 surtax 2011 on taxable net income in excess of 50000.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The average cumulative sales tax rate between all of them is 85. What is the sales tax rate in North Wichita Kansas.

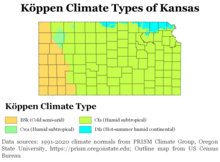

The Kansas state sales tax rate is currently. Kansas has a 65 statewide sales tax rate but also has 530 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 199 on top of the state tax. The Kansas statewide sales and use tax rate is 65.

The City Council approved the Greenwich K-96 CID on March 8 2011 to facilitate the construction of infrastructure site improvements parking and landscaping costs associated. 3 lower than the maximum sales tax in KS. The Kansas sales tax rate is currently.

The minimum combined 2022 sales tax rate for North Wichita Kansas is.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Total Gross Domestic Product For Wichita Ks Msa Ngmp48620 Fred St Louis Fed

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Kansas Sales Tax 8th Highest In The Nation The Sentinel

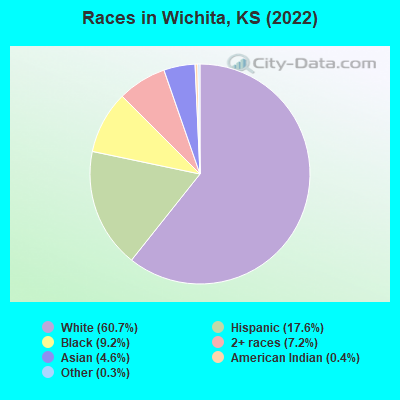

Wichita Kansas Ks Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wichita Ks Pet Friendly Apartments Houses For Rent 28 Rentals Zillow

My Local Taxes Sedgwick County Kansas

Meridian 53rd St North Sw C Wichita Ks 67204 Loopnet

Kansas Has 9th Highest State And Local Sales Tax Rate The Sentinel

Kansas Department Of Revenue Home Page

Does Kansas Charge Sales Tax On Services Taxjar

Kansas Income Tax Calculator Smartasset

Financial Reports And Documents Sedgwick County Kansas

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Is Shipping Taxable In Kansas Taxjar

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector